The operators, under the aegis of the Association of Telecommunications Companies of Nigeria (ATCON), said the banks should only be allowed to apply a cost recovery charge to the consumers using the USSD platform or any other telecom related platform used to gain access to the consumers’ mobile device or the Subscribers Identification Modules (SIM).

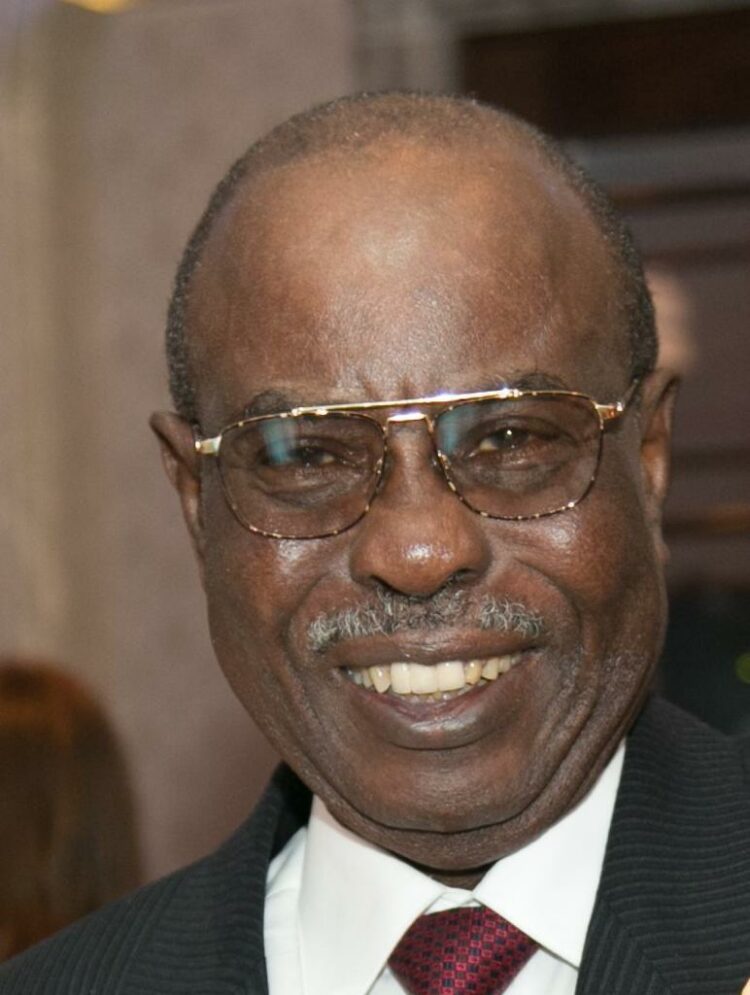

Speaking with The Guardian, the President of the ATCON, Olusola Teniola, alleged that the banking community is not being transparent in the way they apply charges to the consumers when accessing services via USSD.

According to him, there is a need for the Minister of Communications, Dr. Isa Pantami and the CBN Governor, Godwin Emefiele to intervene and ensure that NCC’s determination is fully implemented and that costs borne by the banks that allows them to access the USSD platform is absorbed by them. He said this would resolve the current issue.

Furthermore, Teniola, while speaking on the matter via the telephone yesterday morning on Sunrise Daily, the early morning show of Channels Tv, carpeted the CBN Governor for saying that the USSD is a sunk cost to the telecommunications operators.

Emefiele had in an interview with journalists, claimed that the use of USSD was a sunk cost to telecoms operators, saying it is not an additional cost on the infrastructure of the service providers.

READ ALSO: Guinea Court Jails Opposition Leaders For Staging Protest

According to the CBN Governor, the telecoms companies disagreed, and claimed that it is an additional investment in infrastructure and “for that reason, they said it must be implemented.”

But Teniola said it is an additional cost, which relates to an increase in the usage of USSD over and above what the platform was originally built for under the GSM specification in the 1990s.

The ATCON president explained that capacity improvements, network facilities and traffic provisioning require additional investments in fiber interconnections, massive increases in computing power and operational support that interfaces to the banking sector to provide a safe and secure consumer experience over the USSD platform.

According to him, ‘‘with all due respect to him, the CBN Governor is wrong to say USSD platform is a sunk cost on the operators and that the banks can patronise operators that can provide the service at almost zero cost.

“The USSD platform enables more than 75 percent of the 175 million subscribers on the GSM network to have access to basic data. This technology is used by the GSM operators to allow infotainment, information sharing, some social services for free. But the banking sector has deliberately used this same platform to rake in billions of Naira by charging their consumers before they can have access to their bank accounts, among others at rates that are not allowing the country’s financial inclusion to expand and increase.

“You will agree with me that there have been huge outcries by bank customers that the costs of accessing their accounts are exorbitant. The banks charge arbitrarily for anything, even when you don’t request for such services, they lord it on customers.”

According to him, though the Minister of Communications has called for the suspension of the plan, ‘‘but that status quo won’t solve the problem because the cost applied via USSD section by the bank is unfair and those costs need to be reduced so that the financial inclusion we are trying to realise in Nigeria can increase and it is purely in the hands of the banks.’’

Teniola said the USSD platform is an infrastructure that needs to be paid for, it is an infrastructure that is being used by majority of people that have basic feature phones and it will require investments to not only increase the capacity to enable that to continue but also ensure the coverage, especially towards bridging access gaps in the country.

He said there is the need for an urgent dialogue, which will have the CBN Governor, the NCC, telecoms operators and the banks to ensure that something amicable is done for all the parties involved and the ₦4 charge becomes applicable.

The ATCON president maintained that the need to introduce the cost actually came from the banks, stressing that there is a cost to actually providing digital services, which ought to be borne by the financial institutions. According to him, the cost should be borne by the banks because over and beyond what the USSD was built for, ‘‘and remember that usually, the USSD platform is On-Net that is, it is connected to your service providers’ network and not interoperable different networks, so the mere fact that the USSD platform is being extended and use in manners that it wasn’t actually built and design for, suggest that the banks are the ones that needs to carry that cost to enable their clients and consumers to access their bank accounts via the mobile phones.

“But this cost is determined and depends by which operator they go to, however, we can’t have a situation where the banks are not charging at cost-recovery level, but doing cost recovery plus a margin. That margin is excessive and expensive! It is what is causing the consumers to complain. That margin has to come down. We can’t have bankers using this platform to generate non -interest income when they should be focusing on giving out loans to SMEs.”

According to him, there has to be a realisation from the banking community that the telecommunications operators have every right to recover their cost, so also the banks, “but the banks don’t want the telcos to recover their cost. This is not acceptable in any normal community. The infrastructures are owned by telecoms operators. The banks must realised that the technology cannot be controlled by them, therefore, there is a need for them to meet and ratify the cost they are trying to push to consumers that it is just cost recovery and not cost recovery with a margin.”

Going forward, Teniola suggested that the charges and fees which the banks are imposing on consumers should be shared. He said there must be a discussion around the whole composition of the margin applied above the cost recovery that the banks are actually applying on consumers, ‘‘and this has to be done in a transparent and open manner. This will only work through partnership and collaboration; otherwise, we will be back in the same spot when another technology comes forward. I understand the tension whether the financial inclusion should be bank-led or telco-led. If you look at other jurisdiction, it is very obvious that in Nigeria, we don’t have fixed lines, so the mobile device is the single most ubiquitous access to any digital service, which also the banks use, so we must channel efforts together and arrive at win-win situation for the country.”