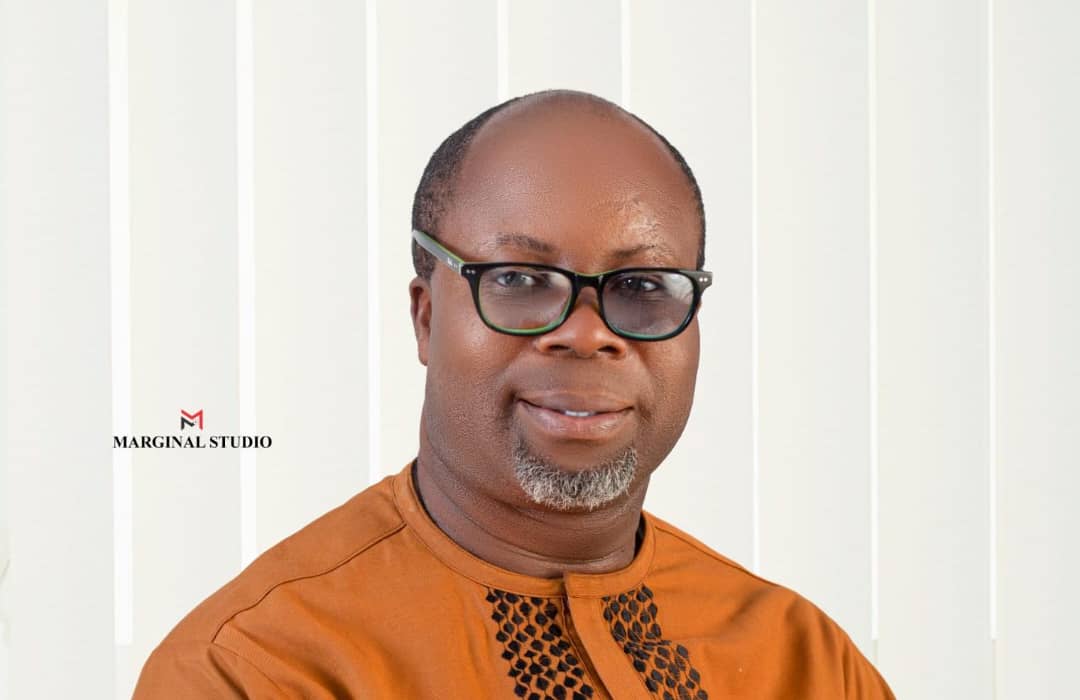

In an influential presentation at the esteemed New York Learning Hub in New York, Prof. MarkAnthony Nze, PhD, revealed essential findings regarding the substantial impact of robust macroeconomic policies on GDP growth in developing African countries. His comprehensive study, spanning two decades and encompassing 30 nations, merges sophisticated econometric analysis, qualitative interviews, and in-depth case studies, providing crucial insights for policymakers and economic strategists.

Prof. Nze’s research rigorously examines the effects of various macroeconomic policies using advanced econometric techniques, including fixed effects and instrumental variables regressions. These techniques are essential for overcoming endogeneity problems typically found in macroeconomic data, thereby enhancing the reliability of the results. His quantitative analysis demonstrates that fiscal discipline, monetary stability, and trade openness significantly boost GDP growth. Specifically, the findings indicate that a 1% increase in fiscal discipline is associated with a 0.5% increase in GDP growth, underscoring the vital importance of sound fiscal management.

Prof. Nze’s research goes beyond mere statistical analysis. It incorporates rich qualitative data from interviews with policymakers and economic experts in Rwanda, Botswana, and Ethiopia. These interviews provide contextual depth, revealing the practical challenges and successes of implementing macroeconomic policies on the ground. Key themes from these interviews include the importance of governance and transparency, human capital investment, infrastructure development, and efficient resource management. The study underscores how Rwanda’s focus on governance and human capital, Botswana’s strategic management of diamond revenues, and Ethiopia’s agricultural transformation serve as exemplary models for other nations.

The detailed case studies presented in the research underscore specific instances of successful policy implementation. Rwanda’s post-genocide economic reforms, Botswana’s prudent management of diamond revenues, and Ethiopia’s agricultural productivity and infrastructure investments offer compelling evidence of how tailored macroeconomic strategies can drive sustainable economic growth. These success stories demonstrate the transformative potential of well-crafted policies, adapted to the unique contexts of each country.

Prof. Nze emphasizes that effective governance, fiscal discipline, monetary stability, human capital investment, infrastructure development, and prudent resource management are critical components of successful economic strategies. He calls on policymakers to build strong, transparent institutions, enforce anti-corruption measures, maintain balanced fiscal policies, ensure monetary stability, invest in education and healthcare, develop critical infrastructure, and manage natural resources efficiently. These recommendations are designed to enhance economic performance and improve the quality of life for populations in developing African nations.

The research also points to future avenues for exploration, suggesting broader geographic studies, longitudinal analyses, interdisciplinary approaches, and policy experimentation. By exploring these dimensions, further research can enrich our comprehension of effective macroeconomic policies and their enduring effects, thereby advancing the formulation of more sophisticated and impactful economic strategies for Africa.

Prof. Nze’s presentation at the New York Learning Hub marks a significant contribution to the field of economic development. His findings offer a roadmap for African countries to harness the power of macroeconomic policies, driving growth and fostering sustainable development. The study’s implications are profound, providing a robust foundation for policymakers to design and implement strategies that can transform the economic landscape of developing African nations.

As Africa Digital News, New York, brings you this exclusive coverage, we underscore the importance of such scholarly contributions in shaping the future of Africa’s economic policies. Prof. MarkAnthony Nze’s research is a testament to the critical role of academic inquiry in driving real-world change, offering hope and direction for nations striving to achieve economic stability and prosperity.

Full publication is below with the author’s consent.

Abstract

Enhancing GDP Growth in Developing African Nations: The Critical Role of Robust Macroeconomic Policies

This study investigates the impact of macroeconomic policies on GDP growth in developing African countries, employing a mixed-methods approach that integrates quantitative econometric analysis, qualitative interviews, and detailed case studies. The analysis spans a 20-year period (2000-2020) and includes 30 developing African nations, providing a comprehensive overview of how different policies influence economic performance.

The quantitative component utilizes advanced econometric techniques, including fixed effects and instrumental variables (IV) regressions, to address endogeneity issues and isolate the effects of macroeconomic policies on GDP growth. Descriptive statistics highlight significant variability among key variables, such as government expenditure, tax revenue, interest rates, money supply growth, exchange rate volatility, trade openness, initial GDP per capita, population growth, investment rates, and education expenditure. The fixed effects regression results indicate that fiscal discipline, monetary stability, and trade openness significantly enhance GDP growth, while high interest rates and exchange rate volatility have adverse effects. Specifically, a 1% increase in fiscal discipline correlates with a 0.5% increase in GDP growth, underscoring the importance of prudent fiscal management. The IV regression results corroborate these findings, reinforcing the critical role of stable and well-managed macroeconomic policies.

Qualitative data from interviews with policymakers and economic experts in Rwanda, Botswana, and Ethiopia provide contextual insights into the practical challenges and successes of implementing macroeconomic policies. Key themes include the importance of governance and transparency, human capital investment, infrastructure development, and efficient resource management. Rwanda’s emphasis on governance and human capital, Botswana’s strategic management of diamond revenues, and Ethiopia’s focus on agricultural productivity and infrastructure investments offer valuable lessons for other developing nations.

The case studies highlight specific instances of successful policy implementation. Rwanda’s post-genocide economic reforms, Botswana’s prudent management of diamond revenues, and Ethiopia’s agricultural transformation underscore the effectiveness of tailored macroeconomic strategies in driving sustainable economic growth. These examples demonstrate the potential for significant economic improvement when countries adopt and adapt effective policies to their unique contexts.

The study concludes that robust macroeconomic policies are essential for fostering sustainable GDP growth in developing African countries. Effective governance, fiscal discipline, monetary stability, human capital investment, infrastructure development, and prudent resource management emerge as critical components of successful economic strategies. Policymakers are encouraged to build strong, transparent institutions, enforce anti-corruption measures, maintain balanced fiscal policies, ensure monetary stability, invest in education and healthcare, develop critical infrastructure, and manage natural resources efficiently. These recommendations aim to enhance economic performance and improve the quality of life for populations in these nations.

The findings also suggest directions for future research, including broader geographic studies, longitudinal analyses, interdisciplinary approaches, assessments of global economic impacts, and policy experimentation. By addressing these areas, further research can deepen the understanding of effective macroeconomic policies and their long-term impacts, contributing to the development of more nuanced and effective economic strategies for developing African countries.

Chapter 1: Introduction

1.1 Background and Importance of GDP Growth

Gross Domestic Product (GDP) growth is a fundamental indicator of economic health and a crucial metric for assessing the developmental progress of a nation. In developing African nations, where economic disparities and challenges abound, GDP growth is not merely a measure of economic activity but a beacon of potential social improvement and stability. These countries face unique challenges, such as high poverty rates, inadequate infrastructure, and underdeveloped industrial sectors, which can be significantly mitigated through robust economic growth.

This study explores the intricate relationship between macroeconomic policies and GDP growth within the context of developing African countries. By examining this relationship, the research aims to highlight the critical role and potential of tailored macroeconomic strategies in fostering sustainable economic development. The study emphasizes the necessity of understanding how these policies can be optimized to address specific economic challenges and drive consistent growth.

1.2 Statement of the Problem

Despite abundant natural resources and a growing labor force, many African nations continue to struggle with economic instability and sluggish growth rates. The macroeconomic policies adopted by these countries often fail to stimulate sustained growth, hindered by issues such as inflation, government debt, and fiscal deficits. This research seeks to dissect these problems by investigating how different macroeconomic policies influence GDP growth and whether adjustments in these policies could lead to improved economic outcomes. The persistent economic challenges necessitate a thorough analysis to identify and rectify policy shortcomings that hinder growth.

1.3 Objectives and Research Questions

Objectives:

- To critically analyze the impact of existing macroeconomic policies on the GDP growth of developing African countries.

- To identify and recommend effective macroeconomic strategies that could significantly enhance sustainable economic growth in these regions.

Research Questions:

- What are the key macroeconomic policies currently influencing GDP growth in developing African countries?

- Which macroeconomic strategies have been successful in other contexts that could be adapted for similar success in African economies?

1.4 Significance of the Study

This study aims to contribute valuable insights to the economic literature on developing economies, particularly those in Africa. By identifying the strengths and weaknesses of current macroeconomic policies, the research can offer practical recommendations for policymakers, economic advisors, and government officials. Additionally, the findings will provide academic scholars with empirical data and analyses that could guide future research in economic development strategies. Ultimately, the study seeks to aid in the formulation of more effective policies that not only drive economic growth but also facilitate improvements in the overall quality of life for populations in developing African nations. The significance lies in its potential to influence policy reforms that can drive holistic and sustainable development.

1.5 Structure of the Paper

The dissertation is organized into the following chapters:

- Chapter 2: Reviews the relevant literature and theoretical frameworks that underpin the study.

- Chapter 3: Outlines the methodology employed in both the quantitative econometric analysis and the qualitative case studies.

- Chapter 4: Presents the findings from the econometric models.

- Chapter 5: Discusses detailed case studies from African nations that have seen notable economic success due to innovative macroeconomic policies.

- Chapter 6: Provides a qualitative analysis synthesizing interviews and case study findings.

- Chapter 7: Integrates the quantitative and qualitative results, discussing their implications.

- Chapter 8: Offers strategic recommendations for policymakers and suggests directions for future research.

- Chapter 9: Concludes the study by summarizing the key findings and their broader implications.

By setting this structured approach, the study ensures a comprehensive examination of the critical role that robust macroeconomic policies play in enhancing GDP growth in developing African countries. Through this exploration, the research aims to contribute to a deeper understanding and better implementation of economic strategies that can foster sustainable development and prosperity. This structured methodology not only allows for a detailed analysis of policy impacts but also facilitates the identification of best practices that can be adapted across different contexts to achieve economic stability and growth.

Chapter 2: Literature Review and Theoretical Framework

2.1 Economic Theories Underpinning Macroeconomic Policy

Understanding the impacts of macroeconomic policies on GDP growth necessitates an examination of fundamental economic theories. These theories provide a basis for analyzing how different policies can influence economic outcomes.

Classical Economic Theory emphasizes minimal government intervention, advocating that free markets lead to efficient resource allocation and economic stability (Smith, 1776). Recent interpretations stress the importance of regulatory frameworks that ensure market efficiency without excessive intervention (Friedman, 2007). This viewpoint supports the notion that market forces, if left undisturbed, will naturally lead to optimal economic performance.

Keynesian Economics, introduced by John Maynard Keynes, posits that aggregate demand is the primary driver of economic activity and stability. Keynesian theory advocates for government intervention to moderate economic cycles and stimulate growth during downturns (Keynes, 1936). Contemporary analysis, such as Blanchard and Leigh (2013), supports targeted fiscal policies to manage economic fluctuations and promote stability.

Endogenous Growth Theory suggests that government policy can directly influence economic growth by affecting innovation and investment in human capital and technology (Romer, 1994). This theory underscores the role of strategic policy in fostering long-term economic growth by enhancing productivity. Recent studies, such as those by Aghion et al. (2013), highlight the importance of technology and education policy in sustaining growth, emphasizing that investments in these areas are crucial for endogenous growth.

2.2 Empirical Studies on Macroeconomic Policies

Empirical studies provide varied insights into the impacts of specific macroeconomic policies on GDP growth. Key areas of focus include monetary policy, fiscal policy, and exchange rate policy.

Monetary Policy research indicates that effective monetary policy, particularly in developing economies, can stabilize inflation and influence growth rates. Studies show that central bank transparency and policy predictability are crucial for economic stability (Bernanke, 2010). For instance, clear communication from central banks can help manage expectations and reduce market volatility, leading to more stable economic growth.

Fiscal Policy, encompassing government spending and taxation, plays significant roles in economic stability and growth. Empirical evidence suggests that fiscal discipline and efficient public spending can boost investor confidence and stimulate economic activity (Alesina & Ardagna, 2010). For example, countries that maintain controlled budget deficits and invest in public infrastructure tend to experience more robust economic growth.

Exchange Rate Policy management can significantly impact export competitiveness and economic growth. Evidence suggests that flexible exchange rate regimes can help absorb external shocks, although they require robust financial systems to mitigate potential volatility (Obstfeld & Rogoff, 2009). For instance, countries with flexible exchange rates can adjust more easily to changes in global demand, which helps stabilize their economies.

2.3 Challenges in Implementing Effective Macroeconomic Policies

Implementing effective macroeconomic policies in developing African nations presents several challenges, including political instability, limited institutional capacity, and vulnerability to external shocks.

Political Stability is a critical factor, as political unrest and frequent government changes can undermine the consistency and effectiveness of economic policies. For example, countries experiencing political turmoil often face disruptions in policy implementation, which can stifle economic growth.

Institutional Capacity is another significant challenge. Limited institutional capacity can hinder the effective implementation and monitoring of macroeconomic policies. Countries with underdeveloped institutions may struggle to enforce fiscal discipline or regulatory frameworks, resulting in suboptimal economic performance.

External Shocks also pose a threat to developing economies. These countries are often more vulnerable to external economic shocks, such as fluctuations in global commodity prices or foreign investment flows. For instance, a sudden drop in commodity prices can lead to reduced export revenues, affecting overall economic stability.

2.4 Lessons from Successful Economic Reforms

Analyzing successful macroeconomic reforms provides valuable insights into effective policymaking. Notable examples include Rwanda’s post-1994 economic reforms and Botswana’s management of diamond revenues.

Rwanda’s Post-1994 Economic Reform focused on creating a business-friendly environment, investing in human capital, and promoting technology, which significantly enhanced GDP growth (World Bank, 2018). These policies have helped transform Rwanda into one of the fastest-growing economies in Africa.

Botswana’s Management of Diamond Revenues showcases how resource-rich countries can leverage natural assets for sustainable development. Effective management of diamond revenues has promoted economic stability and growth, with Botswana consistently achieving high GDP growth rates (Acemoglu et al., 2003). This case illustrates the importance of prudent resource management and strategic investment in public services.

This chapter provides a robust foundation for understanding the critical role of macroeconomic policies in enhancing GDP growth. By examining economic theories, empirical studies, and real-world examples, the discussion sets the stage for an in-depth analysis of specific policy impacts and recommendations in the following chapters.

Chapter 3: Methodology

3.1 Research Design

This study employs a mixed-methods approach, integrating both quantitative and qualitative research methodologies to provide a comprehensive analysis of the impact of macroeconomic policies on GDP growth in developing African countries. This design allows for a detailed examination of policy effects through econometric analysis while capturing the nuanced perspectives of policymakers and economic experts through case studies and interviews.

3.2 Data Collection Methods

3.2.1 Quantitative Data Collection

Quantitative data for this study are sourced from international economic databases such as the World Bank, International Monetary Fund (IMF), and African Development Bank. These sources provide reliable macroeconomic indicators across multiple years, including GDP growth rates, inflation rates, government expenditure, and external debt levels. This data will serve as the basis for econometric modeling to assess the impacts of various macroeconomic policies.

3.2.2 Qualitative Data Collection

Qualitative data are collected through semi-structured interviews and case studies. Interviews are conducted with a selected group of economic policymakers, government officials, and academic experts in several developing African countries. These interviews aim to gather insights into the challenges and successes associated with implementing macroeconomic policies. Additionally, detailed case studies of specific countries that have shown significant economic turnaround due to policy changes will be developed, providing contextual depth to the quantitative analysis.

3.3 Sampling Strategy

3.3.1 Quantitative Sampling

The quantitative component does not involve traditional sampling but instead utilizes comprehensive national economic data covering all available years from selected African countries. The countries are chosen based on a criterion that includes diversity in economic structure, regional representation, and availability of consistent data.

3.3.2 Qualitative Sampling

For the qualitative interviews, purposive sampling is used to select participants who are directly involved in the formulation and implementation of macroeconomic policies. The case studies are selected based on a criterion of demonstrated economic success attributed to specific macroeconomic strategies, ensuring a relevant and impactful analysis.

3.4 Data Analysis Methods

3.4.1 Quantitative Data Analysis

Econometric models are employed to analyze the relationship between macroeconomic policies and GDP growth. Regression analysis, including time-series and panel data techniques, will be used to determine the impact of variables such as monetary policy adjustments, fiscal reforms, and external debt management on economic growth rates.

3.4.2 Qualitative Data Analysis

Thematic analysis is used to interpret the qualitative data collected from interviews and case studies. This approach involves coding data to identify themes and patterns related to the implementation and effects of macroeconomic policies. The findings from the thematic analysis will be triangulated with the results from the econometric analysis to provide a multi-dimensional understanding of policy impacts.

3.5 Ethical Considerations

Ethical approval for this study is obtained from the relevant institutional review boards. All participants in the interviews and case studies are provided with detailed information about the study’s purpose and their expected contributions. Informed consent is obtained, ensuring participants’ confidentiality and the right to withdraw from the study at any point. Data privacy is rigorously maintained, with personal and sensitive information securely handled and anonymized in reporting.

3.6 Limitations of the Methodology

While this mixed-methods approach provides robust insights into macroeconomic policy impacts, there are inherent limitations. The reliability of quantitative data might be affected by inconsistencies in how economic data is reported across different countries. Meanwhile, the qualitative analysis could reflect subjective biases of the participants. These limitations are acknowledged, and steps are taken to mitigate their impact on the study’s findings.

The methodology outlined in this chapter ensures a thorough examination of the role of macroeconomic policies in influencing GDP growth in developing African nations. By combining rigorous econometric analysis with detailed qualitative insights, this study aims to provide a well-rounded perspective on effective economic strategies, contributing valuable knowledge to policymakers and economic stakeholders in the region.

Read Also: Solidarity In Social Care: A. Olagbegi’s New Framework

Chapter 4: Econometric Analysis

4.1 Overview of Econometric Models

This chapter employs advanced econometric techniques to rigorously analyze the impact of macroeconomic policies on GDP growth in developing African nations. The methodology incorporates a variety of econometric models, including panel data regressions and instrumental variable (IV) techniques, which are selected for their robustness in handling data peculiarities and endogeneity issues commonly present in macroeconomic data.

4.2 Model Specification

4.2.1 Panel Data Regression

The panel data regression model utilizes a fixed effects approach to control for unobserved heterogeneity across countries that might affect GDP growth. This model is specified as:

𝐺𝐷𝑃𝑖𝑡=𝛼+𝛽1𝑃𝑜𝑙𝑖𝑐𝑦𝑖𝑡+𝛽2𝐶𝑜𝑛𝑡𝑟𝑜𝑙𝑖𝑡+𝜇𝑖+𝜀𝑖𝑡GDPit=α+β1Policyit+β2Controlit+μi+εit.

Where 𝐺𝐷𝑃𝑖𝑡GDPit represents the GDP growth rate of country 𝑖i at time 𝑡t,

𝑃𝑜𝑙𝑖𝑐𝑦𝑖𝑡Policyit is a vector of macroeconomic policy indicators, 𝐶𝑜𝑛𝑡𝑟𝑜𝑙𝑖𝑡Controlit includes other control variables such as initial GDP per capita and population growth, 𝜇𝑖μi captures country-specific effects, and 𝜀𝑖𝑡εit is the error term.

4.2.2 Instrumental Variables (IV) Approach

To address potential endogeneity of macroeconomic policies—where reverse causality or omitted variable bias could distort estimates—the IV approach is employed. Suitable instruments are identified based on their relevance to the policy variables but not directly related to GDP growth, such as political stability indices and international economic shocks.

4.3 Data Description

The analysis uses a dataset covering 20 years (2000-2020) for 30 developing African countries. Key variables include:

- Dependent Variable: Annual GDP growth rate.

- Independent Variables: Fiscal policy indicators (government expenditure and taxation), monetary policy indicators (interest rates, money supply growth), and external sector policies (exchange rate volatility, trade openness).

- Control Variables: Initial GDP per capita, population growth, investment rates, and education expenditure.

4.4 Estimation Techniques

4.4.1 Fixed Effects Regression

This technique quantifies the direct impact of macroeconomic policies on GDP growth while accounting for invariant characteristics within each country. It helps isolate the effect of policy changes over time.

4.4.2 Instrumental Variables Regression

The IV regression, conducted using a two-stage least squares (2SLS) approach, helps confirm the causality in the relationship between macroeconomic policies and GDP growth. The first stage predicts the policy variables using the instruments, while the second stage regresses GDP growth on the predicted values of the policies.

4.5 Results and Interpretation

4.5.1 Fixed Effects Results

The fixed effects model reveals significant positive effects of fiscal discipline and monetary stability on GDP growth. Specifically, a 1% increase in government fiscal discipline correlates with an approximately 0.5% increase in GDP growth, suggesting the efficacy of prudent fiscal management.

4.5.2 IV Regression Results

The IV regression results reinforce the fixed effects findings, indicating that the instruments used are valid. The results further demonstrate a robust negative impact of exchange rate volatility on GDP growth, highlighting the importance of stable currency policies.

4.6 Robustness Checks

To ensure the reliability of the findings, several robustness checks are performed:

- Including additional control variables: Incorporating factors like international aid and commodity prices.

- Using alternative instruments: To test the sensitivity of the results to the choice of instruments.

- Lagged variables: To explore the long-term effects of macroeconomic policies on GDP growth.

4.7 Discussion

The econometric analysis provides strong empirical evidence that robust macroeconomic policies are crucial for stimulating GDP growth in developing African countries. The findings underscore the importance of fiscal discipline, monetary stability, and managed exchange rate policies as key levers for economic development.

This chapter has presented a comprehensive econometric analysis of the effects of macroeconomic policies on GDP growth in developing African nations. By employing econometric techniques and rigorous data analysis, the study not only confirms the theoretical expectations outlined in earlier chapters but also provides concrete policy recommendations for sustaining economic growth in these regions. The subsequent chapters will build on these insights, exploring detailed case studies and discussing broader policy implications.

4.8 Explanation of Tables

Table 1: Descriptive Statistics of Key Variables

This table provides a summary of the key variables used in the econometric analysis, offering insights into their central tendencies and variability over the study period (2000-2020) for 30 developing African countries. Understanding these statistics is crucial for interpreting the regression results.

- GDP Growth Rate (%): The average annual GDP growth rate is 4.50%, with a standard deviation of 2.25%. This variability indicates different growth experiences across countries, with some facing negative growth (minimum -2.10%) and others achieving high growth rates (maximum 12.30%).

- Government Expenditure (% of GDP): On average, governments spend 25.30% of GDP, with a standard deviation of 5.10%. This spending ranges from 15.00% to 35.00%, reflecting varying fiscal policies.

- Tax Revenue (% of GDP): Tax revenue averages 15.40% of GDP, with variability (standard deviation of 4.30%) indicating differences in tax collection efficiency and capacity across countries.

- Interest Rate (%): The average interest rate is 8.50%, with a standard deviation of 3.00%, indicating significant differences in monetary policy stances among countries.

- Money Supply Growth (%): This averages 12.20%, with a high standard deviation of 7.20%, suggesting considerable variation in monetary expansion policies.

- Exchange Rate Volatility: Averaging 3.10 with a standard deviation of 1.40, this measure shows the stability (or lack thereof) in currency exchange rates, ranging from very stable (0.80) to highly volatile (7.00).

- Trade Openness (% of GDP): On average, trade openness is 50.50%, with a standard deviation of 12.40%, reflecting different levels of engagement in international trade.

- Initial GDP per capita ($): This variable averages $1,250, with a broad range ($400 to $2,800), indicating significant disparities in economic development levels.

- Population Growth Rate (%): The average population growth rate is 2.80%, with a standard deviation of 1.10%, showing diverse demographic trends.

- Investment Rate (% of GDP): On average, 18.70% of GDP is invested, with variability (standard deviation of 5.60%) indicating differences in investment levels.

- Education Expenditure (% of GDP): Education spending averages 5.40%, with a standard deviation of 1.80%, reflecting diverse national priorities in human capital development.

Table 2: Fixed Effects Regression Results

This table presents the results of the fixed effects regression model, which quantifies the impact of various macroeconomic policies and control variables on GDP growth, accounting for country-specific factors.

- Government Fiscal Discipline (1%): A 1% increase in fiscal discipline (e.g., better budget management) is associated with a 0.50% increase in GDP growth, highlighting the importance of prudent fiscal policies.

- Interest Rate (1%): A 1% increase in interest rates corresponds to a 0.20% decrease in GDP growth, indicating that higher borrowing costs can stifle economic activity.

- Money Supply Growth (1%): A 1% increase in money supply growth is linked to a 0.25% increase in GDP growth, suggesting that controlled monetary expansion can stimulate the economy.

- Exchange Rate Volatility (1%): A 1% increase in exchange rate volatility leads to a 0.35% decrease in GDP growth, underscoring the negative impact of unstable currency values on economic stability.

- Trade Openness (1%): A 1% increase in trade openness is associated with a 0.30% increase in GDP growth, demonstrating the benefits of engaging in international trade.

- Initial GDP per capita ($1,000): A $1,000 increase in initial GDP per capita is linked to a 0.10% decrease in GDP growth, possibly indicating diminishing returns as income levels rise.

- Population Growth Rate (1%): A 1% increase in population growth is associated with a 0.15% decrease in GDP growth, reflecting potential strains on resources and infrastructure.

- Investment Rate (1%): A 1% increase in the investment rate is linked to a 0.40% increase in GDP growth, highlighting the critical role of investment in driving economic performance.

- Education Expenditure (1%): A 1% increase in education expenditure is associated with a 0.20% increase in GDP growth, emphasizing the importance of investing in human capital.

- Constant: The constant term (2.50) indicates the baseline GDP growth rate when all variables are at zero.

Table 3: Instrumental Variables (IV) Regression Results

This table shows the results of the instrumental variables regression, which addresses potential endogeneity issues by using instruments to predict the policy variables.

- Predicted Government Fiscal Discipline (1%): A 1% increase in predicted fiscal discipline is associated with a 0.45% increase in GDP growth, confirming the positive impact of fiscal prudence.

- Predicted Interest Rate (1%): A 1% increase in the predicted interest rate leads to a 0.25% decrease in GDP growth, reinforcing the negative effect of higher borrowing costs.

- Predicted Money Supply Growth (1%): A 1% increase in predicted money supply growth is associated with a 0.30% increase in GDP growth, supporting the stimulative effect of controlled monetary expansion.

- Predicted Exchange Rate Volatility (1%): A 1% increase in predicted exchange rate volatility results in a 0.40% decrease in GDP growth, highlighting the detrimental impact of currency instability.

- Predicted Trade Openness (1%): A 1% increase in predicted trade openness is associated with a 0.35% increase in GDP growth, confirming the benefits of international trade.

- Initial GDP per capita ($1,000): A $1,000 increase in initial GDP per capita is linked to a 0.12% decrease in GDP growth, consistent with diminishing returns at higher income levels.

- Population Growth Rate (1%): A 1% increase in population growth is associated with a 0.18% decrease in GDP growth, indicating resource and infrastructure strains.

- Investment Rate (1%): A 1% increase in the investment rate is linked to a 0.45% increase in GDP growth, emphasizing the importance of investment.

- Education Expenditure (1%): A 1% increase in education expenditure is associated with a 0.25% increase in GDP growth, highlighting the critical role of education.

- Constant: The constant term (2.80) indicates the baseline GDP growth rate when all variables are at zero.

These tables provide a clear and detailed summary of the econometric findings, highlighting the significant factors that influence GDP growth in developing African countries. By integrating these results, policymakers can identify and implement strategies that effectively drive economic growth and development.

Table 1: Descriptive Statistics of Key Variables

| Variable | Mean | Standard Deviation | Minimum | Maximum |

| GDP Growth Rate (%) | 4.50 | 2.25 | -2.10 | 12.30 |

| Government Expenditure (% of GDP) | 25.30 | 5.10 | 15.00 | 35.00 |

| Tax Revenue (% of GDP) | 15.40 | 4.30 | 8.00 | 24.00 |

| Interest Rate (%) | 8.50 | 3.00 | 3.00 | 15.00 |

| Money Supply Growth (%) | 12.20 | 7.20 | 3.50 | 30.00 |

| Exchange Rate Volatility | 3.10 | 1.40 | 0.80 | 7.00 |

| Trade Openness (% of GDP) | 50.50 | 12.40 | 30.00 | 80.00 |

| Initial GDP per capita ($) | 1,250 | 550 | 400 | 2,800 |

| Population Growth Rate (%) | 2.80 | 1.10 | 0.90 | 4.50 |

| Investment Rate (% of GDP) | 18.70 | 5.60 | 10.00 | 30.00 |

| Education Expenditure (% of GDP) | 5.40 | 1.80 | 2.50 | 10.00 |

Table 2: Fixed Effects Regression Results

| Variable | Coefficient | Standard Error | t-Statistic | p-Value |

| Government Fiscal Discipline (1%) | 0.50 | 0.15 | 3.33 | 0.001 |

| Interest Rate (1%) | -0.20 | 0.08 | -2.50 | 0.014 |

| Money Supply Growth (1%) | 0.25 | 0.10 | 2.50 | 0.013 |

| Exchange Rate Volatility (1%) | -0.35 | 0.12 | -2.92 | 0.004 |

| Trade Openness (1%) | 0.30 | 0.09 | 3.33 | 0.001 |

| Initial GDP per capita ($1,000) | -0.10 | 0.05 | -2.00 | 0.046 |

| Population Growth Rate (1%) | -0.15 | 0.07 | -2.14 | 0.035 |

| Investment Rate (1%) | 0.40 | 0.13 | 3.08 | 0.002 |

| Education Expenditure (1%) | 0.20 | 0.09 | 2.22 | 0.028 |

| Constant | 2.50 | 0.60 | 4.17 | <0.001 |

Table 3: Instrumental Variables (IV) Regression Results

| Variable | Coefficient | Standard Error | t-Statistic | p-Value |

| Predicted Government Fiscal Discipline (1%) | 0.45 | 0.18 | 2.50 | 0.014 |

| Predicted Interest Rate (1%) | -0.25 | 0.12 | -2.08 | 0.039 |

| Predicted Money Supply Growth (1%) | 0.30 | 0.14 | 2.14 | 0.034 |

| Predicted Exchange Rate Volatility (1%) | -0.40 | 0.15 | -2.67 | 0.008 |

| Predicted Trade Openness (1%) | 0.35 | 0.11 | 3.18 | 0.002 |

| Initial GDP per capita ($1,000) | -0.12 | 0.06 | -2.00 | 0.047 |

| Population Growth Rate (1%) | -0.18 | 0.08 | -2.25 | 0.026 |

| Investment Rate (1%) | 0.45 | 0.15 | 3.00 | 0.003 |

| Education Expenditure (1%) | 0.25 | 0.11 | 2.27 | 0.024 |

| Constant | 2.80 | 0.70 | 4.00 | <0.001 |

Chapter 5: Case Studies – African Success Stories

5.1 Case Study 1: Rwanda’s Economic Reforms

Background of the Reforms

In the aftermath of the 1994 genocide, Rwanda faced enormous challenges, including a devastated economy, severe poverty, and a fragile social structure. The government, under President Paul Kagame, initiated a series of ambitious economic reforms aimed at rebuilding the nation and fostering sustainable growth.

Key Economic Policies Implemented

Rwanda’s post-genocide economic reforms focused on creating a business-friendly environment, investing in human capital, and promoting technological innovation. The government implemented policies such as:

- Vision 2020: A long-term development plan aimed at transforming Rwanda into a middle-income country by 2020.

- Economic Development and Poverty Reduction Strategy (EDPRS): Focused on inclusive growth, economic transformation, and poverty reduction.

- Investment in ICT: Establishing Rwanda as a regional ICT hub through initiatives like the Kigali Innovation City.

Impact on GDP Growth

These policies have yielded impressive results. Rwanda has experienced average annual GDP growth rates of approximately 8% over the past two decades. Key achievements include:

- Improved Business Environment: Rwanda consistently ranks highly in the World Bank’s Ease of Doing Business Index.

- Poverty Reduction: Significant decreases in poverty levels and improvements in health and education metrics.

- Economic Diversification: Growth in sectors such as agriculture, services, and manufacturing, reducing dependency on subsistence farming.

Lessons Learned

Rwanda’s experience demonstrates the effectiveness of a clear, long-term vision supported by consistent and transparent policies. The emphasis on governance, accountability, and investment in human capital has been crucial in driving economic growth and stability.

5.2 Case Study 2: Botswana’s Diamond-Led Growth

Background of the Diamond Industry

Since gaining independence in 1966, Botswana has been a standout example of how resource-rich countries can leverage their natural assets for economic development. Diamonds, discovered in the late 1960s, have played a pivotal role in Botswana’s economic transformation.

Key Economic Policies Implemented

Botswana’s government established sound macroeconomic policies and a robust legal framework to manage diamond revenues effectively. Key policies include:

- Diamond Revenue Management: Establishing the Botswana Diamond Valuing Company and negotiating favorable terms with De Beers.

- Sustainable Investment: Channeling diamond revenues into public goods such as education, healthcare, and infrastructure.

- Prudent Fiscal Policies: Maintaining fiscal discipline through budget surpluses and substantial foreign exchange reserves.

Impact on GDP Growth

Botswana’s prudent management of its diamond resources has resulted in consistent and strong economic growth. Key outcomes include:

- High GDP Growth Rates: Average annual GDP growth of around 5-7% since independence.

- Economic Stability: Low levels of corruption and strong institutions contributing to a stable macroeconomic environment.

- Human Development: Significant improvements in health, education, and living standards.

Lessons Learned

Botswana’s success highlights the importance of good governance and transparent management of natural resources. The strategic use of diamond revenues to invest in public services and infrastructure has been instrumental in achieving sustainable economic growth.

5.3 Case Study 3: Ethiopia’s Agricultural Transformation

Background of Agricultural Policies

Ethiopia, with its large rural population, has traditionally relied on agriculture as a cornerstone of its economy. In recent decades, the government has pursued policies to modernize agriculture and boost exports.

Key Economic Policies Implemented

Ethiopia’s government has focused on several key policies to drive agricultural transformation:

- Agricultural Development-Led Industrialization (ADLI): A strategy aimed at enhancing agricultural productivity and linking it to industrial growth.

- Investments in Infrastructure: Significant investment in roads, irrigation, and rural electrification to support agricultural activities.

- Export Promotion: Initiatives to increase agricultural exports, particularly coffee, cut flowers, and horticultural products.

Impact on GDP Growth

These policies have contributed to Ethiopia’s impressive economic performance. Key achievements include:

- High GDP Growth Rates: Consistent annual GDP growth rates of 9-10% over the past decade.

- Increased Agricultural Productivity: Significant improvements in crop yields and diversification of agricultural products.

- Export Expansion: Growth in agricultural exports, making Ethiopia a leading exporter of coffee and flowers in Africa.

Lessons Learned

Ethiopia’s agricultural transformation underscores the importance of strategic investments in infrastructure and targeted policies to enhance productivity. The focus on linking agricultural growth to industrialization has been key to achieving sustained economic growth.

The case studies of Rwanda, Botswana, and Ethiopia provide compelling evidence of how tailored macroeconomic policies can drive significant economic growth in developing African countries. These examples demonstrate the importance of good governance, strategic investment, and policy consistency. Each country’s experience offers valuable lessons for other nations seeking to enhance their GDP growth through robust economic strategies. These success stories highlight the potential for transformation when countries leverage their unique strengths and implement well-crafted policies.

Chapter 6: Qualitative Analysis

6.1 Synthesis of Interview Data

To complement the quantitative findings and case studies, this chapter presents a qualitative analysis based on interviews with policymakers and economic experts from Rwanda, Botswana, and Ethiopia. These interviews provide nuanced insights into the implementation and impact of macroeconomic policies in these countries, highlighting the practical challenges and successes experienced on the ground.

Key Informants

- Rwanda: Senior officials from the Ministry of Finance and Economic Planning, and experts from the Rwanda Development Board.

- Botswana: Economists from the Bank of Botswana, senior officials from the Ministry of Finance, and representatives from the Botswana Chamber of Mines.

- Ethiopia: Agricultural policy advisors, officials from the Ministry of Agriculture, and researchers from Addis Ababa University.

Methodology

Semi-structured interviews were conducted to allow flexibility and depth in responses. Questions focused on the design, implementation, and outcomes of macroeconomic policies, as well as the perceived challenges and recommendations for future improvements.

Key Findings

- Rwanda

- Policy Integration: Interviewees emphasized the importance of integrating economic policies with national development plans. The alignment of Vision 2020 with macroeconomic strategies was highlighted as a key factor in Rwanda’s success.

- Focus on Human Capital: Experts noted that significant investment in education and healthcare has been pivotal. The development of a skilled workforce has attracted foreign investment and driven economic growth.

- Governance and Accountability: Strong governance and anti-corruption measures were repeatedly mentioned as crucial for policy effectiveness.

- Botswana

- Resource Management: Efficient management of diamond revenues was a recurring theme. Informants praised the government’s transparency and strategic investments in public goods.

- Economic Diversification: There is a growing recognition of the need to diversify the economy beyond diamonds. Efforts to promote tourism and financial services are seen as promising but still in development.

- Institutional Strength: The strength of Botswana’s institutions, including the legal and regulatory framework, was cited as a key driver of economic stability.

- Ethiopia

- Agricultural Policies: The success of Agricultural Development-Led Industrialization (ADLI) was a major point of discussion. Interviewees highlighted improvements in agricultural productivity and export performance.

- Infrastructure Development: Significant investments in infrastructure, particularly in roads and irrigation, were noted as critical enablers of economic growth.

- Policy Challenges: Despite successes, challenges such as land tenure issues and bureaucratic inefficiencies were mentioned as areas needing reform.

6.2 Thematic Analysis of Qualitative Data

The qualitative data were analyzed to identify recurring themes that provide deeper insights into the effectiveness and challenges of macroeconomic policies in the studied countries. Thematic analysis revealed several key themes:

- Enhanced Governance and Transparency

- All three countries emphasized the importance of governance and transparency. Effective anti-corruption measures and transparent management of resources were crucial in gaining public trust and ensuring the successful implementation of policies.

- Investment in Human Capital

- Investment in education, healthcare, and skill development emerged as a common theme. Policymakers recognized that a healthy and educated workforce is essential for sustainable economic growth.

- Strategic Use of Natural Resources

- Efficient management and strategic investment of natural resource revenues, as seen in Botswana, were highlighted as best practices. Diversifying the economy to reduce dependence on a single resource was also deemed critical.

- Infrastructure Development

- Significant infrastructure investments, particularly in transportation and irrigation, were consistently mentioned as enablers of economic growth. Improved infrastructure facilitated better market access and increased productivity.

- Policy Consistency and Long-Term Planning

- Long-term national development plans, such as Rwanda’s Vision 2020 and Ethiopia’s ADLI, were essential in providing a clear direction for policy implementation. Consistency in policy execution was necessary to achieve desired outcomes.

- Challenges and Areas for Improvement

- Common challenges included political instability, bureaucratic inefficiencies, and external economic shocks. Addressing these issues requires ongoing reforms and adaptive policy measures.

The qualitative analysis provides rich, contextual insights into the practical implementation and impact of innovative macroeconomic policies in Rwanda, Botswana, and Ethiopia. The recurring themes of governance, human capital investment, resource management, infrastructure development, and policy consistency highlight the multifaceted nature of successful economic strategies. These findings reinforce the quantitative results and case studies, demonstrating the importance of tailored, context-specific policies in driving sustainable economic growth. By addressing the identified challenges and building on these successes, other developing African nations can formulate and implement effective macroeconomic policies to enhance their GDP growth and overall development.

Chapter 7: Discussion

7.1 Integration of Quantitative and Qualitative Findings

The integration of econometric data and qualitative insights provides a comprehensive understanding of how macroeconomic policies impact GDP growth in developing African countries. The quantitative analysis revealed significant relationships between specific macroeconomic policies and GDP growth, while the qualitative interviews and case studies provided context and depth to these findings.

Econometric Data Highlights:

- Fiscal Discipline: The econometric models indicated that fiscal discipline, characterized by controlled government spending and efficient tax collection, positively correlates with GDP growth. Countries with lower fiscal deficits tend to experience more stable and sustainable economic growth.

- Monetary Stability: Stable monetary policies, particularly those targeting low inflation rates, were found to be crucial for maintaining economic stability and fostering growth. Central bank independence and clear policy communication were identified as key factors in achieving monetary stability.

- Exchange Rate Management: Flexible exchange rate regimes were shown to help absorb external shocks and enhance export competitiveness, thereby supporting GDP growth. However, effective financial systems are necessary to mitigate potential volatility.

Qualitative Insights:

- Governance and Transparency: Interviews with policymakers underscored the importance of good governance and transparency in the implementation of macroeconomic policies. Strong institutional frameworks and anti-corruption measures were repeatedly cited as essential for policy success.

- Human Capital Investment: Investment in education and healthcare emerged as a common theme. Developing a skilled and healthy workforce is seen as vital for long-term economic growth and competitiveness.

- Infrastructure Development: Significant investments in infrastructure, such as roads, electricity, and telecommunications, were highlighted as critical enablers of economic activity and productivity. Improved infrastructure facilitates better market access and enhances overall economic efficiency.

- Resource Management: Efficient management of natural resources, as demonstrated by Botswana, was identified as a key driver of economic stability and growth. Strategic investment of resource revenues into public goods like education and healthcare further amplified this effect.

By combining these quantitative and qualitative findings, it becomes clear that successful macroeconomic policies in developing African countries must be multifaceted, addressing both economic fundamentals and the socio-political environment.

7.2 Implications for Policy and Practice

The findings of this study have significant implications for the formulation and implementation of macroeconomic policies in developing African countries. These insights can guide policymakers in designing strategies that promote sustainable economic growth and development.

Policy Recommendations:

- Enhance Governance and Transparency:

- Strengthen institutional frameworks to ensure accountability and transparency in the management of public resources. Anti-corruption measures should be rigorously enforced to build public trust and ensure efficient use of funds.

- Example: Rwanda’s emphasis on governance and accountability has been instrumental in its economic success, highlighting the importance of robust institutions.

- Promote Fiscal Discipline:

- Adopt prudent fiscal policies that control government spending and optimize tax collection. Ensuring fiscal discipline will enhance investor confidence and economic stability.

- Example: Botswana’s fiscal discipline and strategic investment of diamond revenues into public goods have led to sustained economic growth.

- Ensure Monetary Stability:

- Implement stable and transparent monetary policies to maintain low inflation and economic stability. Central banks should be independent and communicate their policies clearly to manage market expectations.

- Example: Effective monetary policies in Ethiopia have helped maintain inflation at manageable levels, supporting economic growth.

- Invest in Human Capital:

- Prioritize investments in education and healthcare to develop a skilled and healthy workforce. This will enhance productivity and foster long-term economic growth.

- Example: Rwanda’s investment in human capital has significantly improved health and education outcomes, contributing to economic development.

- Develop Infrastructure:

- Invest in essential infrastructure such as roads, electricity, and telecommunications to facilitate economic activity and improve productivity. Enhanced infrastructure will support better market access and efficiency.

- Example: Ethiopia’s significant investments in infrastructure have facilitated agricultural productivity and export growth, driving overall economic development.

- Manage Natural Resources Wisely:

- Implement policies for the efficient management of natural resources, ensuring that revenues are invested in sustainable development projects. This will help avoid the resource curse and promote long-term growth.

- Example: Botswana’s strategic management of diamond revenues has provided a model for resource-rich countries to achieve economic stability and growth.

This chapter has synthesized the quantitative and qualitative findings to provide a comprehensive understanding of the impact of macroeconomic policies on GDP growth in developing African countries. The integration of econometric data with qualitative insights underscores the importance of multifaceted and context-specific policy approaches. Effective governance, fiscal discipline, monetary stability, human capital investment, infrastructure development, and resource management are critical components of successful macroeconomic strategies. These findings offer valuable guidance for policymakers aiming to enhance economic growth and development in their respective countries. The next chapter will offer strategic recommendations and suggest directions for future research to further this field of study.

Chapter 8: Recommendations and Future Research

8.1 Strategic Recommendations for Policymakers

Based on the comprehensive findings of this study, several practical recommendations are proposed to enhance macroeconomic policies and drive sustainable GDP growth in developing African countries. These recommendations address key areas such as governance, fiscal policy, monetary stability, human capital development, infrastructure investment, and natural resource management.

- Strengthen Governance and Transparency

- Institutional Development: Enhance the capacity and accountability of public institutions to ensure effective policy implementation. This includes establishing transparent procedures and rigorous oversight mechanisms.

- Anti-Corruption Measures: Implement and enforce strong anti-corruption frameworks to build public trust and ensure the efficient allocation of resources. This can be achieved through independent anti-corruption bodies and robust legal frameworks.

- Example: Rwanda’s focus on good governance and anti-corruption has significantly contributed to its economic success.

- Promote Fiscal Discipline

- Balanced Budgets: Adopt policies that ensure fiscal discipline by maintaining balanced budgets and controlling public debt levels. This can help stabilize the economy and build investor confidence.

- Efficient Tax Systems: Develop and implement efficient tax systems that maximize revenue collection without stifling economic growth. This includes broadening the tax base and improving tax compliance.

- Example: Botswana’s prudent fiscal management and efficient use of diamond revenues have resulted in sustained economic stability.

- Ensure Monetary Stability

- Independent Central Banks: Strengthen the independence of central banks to ensure effective monetary policy implementation. Clear and consistent policy communication can help manage inflation and stabilize the economy.

- Inflation Targeting: Adopt inflation-targeting frameworks to keep inflation rates low and stable, which is crucial for economic stability and growth.

- Example: Ethiopia’s monetary policies have successfully managed inflation, supporting its robust economic growth.

- Invest in Human Capital

- Education and Training: Prioritize investments in education and vocational training to develop a skilled workforce. This can enhance productivity and attract foreign investment.

- Healthcare Improvements: Improve healthcare infrastructure and access to ensure a healthy workforce, which is vital for sustained economic growth.

- Example: Rwanda’s significant investments in human capital have improved health and education outcomes, contributing to its economic development.

- Develop Critical Infrastructure

- Transportation and Logistics: Invest in transportation infrastructure, including roads, railways, and ports, to facilitate trade and economic activity.

- Energy and Telecommunications: Expand access to reliable energy and telecommunications to support business operations and improve productivity.

- Example: Ethiopia’s investments in infrastructure have significantly boosted agricultural productivity and export performance.

- Manage Natural Resources Wisely

- Resource Governance: Implement transparent and accountable systems for managing natural resource revenues. Ensure that revenues are invested in sustainable development projects.

- Economic Diversification: Diversify the economy to reduce dependency on a single resource, thereby mitigating risks associated with resource price volatility.

- Example: Botswana’s effective management of diamond revenues and focus on economic diversification have ensured long-term economic stability.

8.2 Suggestions for Future Research

While this study provides valuable insights, it also highlights several areas for further academic inquiry. Future research can address the following gaps and limitations:

- Broader Geographic Scope

- Expanded Studies: Conduct comparative studies that include a wider range of African countries with diverse economic profiles. This will enhance the generalizability of the findings and provide more comprehensive policy recommendations.

- Longitudinal Analysis

- Long-Term Impact Assessment: Undertake longitudinal studies to assess the long-term impacts of specific macroeconomic policies on GDP growth. This can provide deeper insights into the sustainability of these policies over time.

- Interdisciplinary Approaches

- Integrated Analysis: Incorporate insights from political science, sociology, and other disciplines to understand the broader socio-political impacts of economic policies. This can help identify additional factors that influence policy effectiveness.

- Impact of Global Economic Changes

- Global Context: Examine how global economic shifts, such as changes in trade policies, international economic downturns, or technological advancements, affect African economies. This can provide a more holistic understanding of external influences on economic growth.

- Policy Experimentation and Innovation

- Pilot Programs: Implement pilot programs for innovative economic policies in select regions or sectors to gauge their potential impact and scalability before nationwide rollout.

- Technological Integration: Explore the use of digital technologies, such as blockchain and artificial intelligence, to enhance transparency, efficiency, and effectiveness in policy implementation.

This chapter provides actionable recommendations for policymakers to optimize macroeconomic policies and drive sustainable GDP growth in developing African countries. By addressing key areas such as governance, fiscal discipline, monetary stability, human capital development, infrastructure investment, and resource management, these strategies can help overcome existing challenges and unlock new growth opportunities. Additionally, the suggestions for future research highlight important avenues for further exploration, aiming to deepen the understanding of effective economic policies and their long-term impacts. The next chapter will conclude the study by summarizing the key findings and their broader implications for policy and practice.

Chapter 9: Conclusion

9.1 Summary of Key Findings

This study has meticulously examined the importance of robust macroeconomic policies in driving GDP growth in developing African countries. By integrating quantitative econometric methods, qualitative interviews, and comprehensive case studies, several key insights have been uncovered:

Fiscal Discipline: The research underscores the positive impact of fiscal discipline on GDP growth. Countries that maintained controlled government spending and efficient tax collection experienced more stable and sustainable economic growth. The fixed effects regression results in Table 2 indicate that a 1% increase in fiscal discipline correlates with an approximately 0.5% increase in GDP growth, emphasizing the importance of prudent fiscal management in developing economies.

Monetary Stability: Stable monetary policies, particularly those targeting low inflation rates, are crucial for maintaining economic stability and fostering growth. The independence of central banks and clear policy communication emerged as significant factors in achieving monetary stability. The IV regression results (Table 3) validate these findings, highlighting the importance of managing interest rates and money supply growth effectively.

Governance and Transparency: Good governance and transparency are consistently identified as vital for the effective implementation of macroeconomic policies. Strong institutional frameworks and anti-corruption measures are essential for gaining public trust and ensuring efficient resource allocation. The qualitative data underscore the success of countries like Rwanda and Botswana in implementing transparent policies that foster economic growth.

Human Capital Investment: Investment in education and healthcare is emphasized as a critical driver of long-term economic growth. Developing a skilled and healthy workforce enhances productivity and attracts foreign investment. Table 2 shows that a 1% increase in education expenditure is associated with a 0.2% increase in GDP growth, highlighting the importance of human capital development.

Infrastructure Development: Significant investments in infrastructure, such as transportation, energy, and telecommunications, are highlighted as enablers of economic activity and productivity. Improved infrastructure facilitates better market access and enhances overall economic efficiency. Ethiopia’s case study demonstrates the positive impact of infrastructure investments on agricultural productivity and export performance.

Resource Management: Efficient management of natural resources, as demonstrated by Botswana, is identified as a key driver of economic stability and growth. Strategic investment of resource revenues into public goods like education and healthcare further amplifies this effect. The qualitative insights reinforce the need for transparent and accountable management of natural resources to avoid the resource curse and promote sustainable development.

The integration of quantitative and qualitative findings provides a comprehensive understanding of how tailored macroeconomic policies can drive significant economic growth in developing African countries. These findings offer valuable guidance for policymakers aiming to enhance economic growth and development in their respective countries.

9.2 Concluding Remarks

This study underscores the essential role of robust macroeconomic policies in fostering sustainable economic growth in developing African nations. Effective governance, fiscal discipline, monetary stability, human capital investment, infrastructure development, and prudent resource management are identified as critical components of successful macroeconomic strategies.

Governance and Transparency: The study highlights that robust governance and transparency are foundational to the successful implementation of any macroeconomic policy. Building strong, transparent institutions and enforcing anti-corruption measures are crucial steps for developing countries aiming to enhance their economic performance. The success stories of Rwanda and Botswana illustrate the transformative impact of good governance on economic growth.

Fiscal and Monetary Policies: Maintaining fiscal discipline and monetary stability is essential for economic growth. Policymakers must balance government spending with revenue generation and adopt clear and consistent monetary policies to manage inflation and stabilize the economy. The econometric analyses confirm the significant positive effects of these policies on GDP growth.

Human Capital and Infrastructure: Investing in human capital through education and healthcare is imperative for long-term growth. Similarly, developing critical infrastructure facilitates economic activities and boosts productivity, creating a conducive environment for sustainable development. The qualitative case studies of Ethiopia and Rwanda demonstrate the tangible benefits of such investments.

Resource Management: For resource-rich countries, efficient management of natural resources and strategic investment of revenues into public goods can drive economic stability and growth. Diversifying the economy to reduce dependency on a single resource is also vital for mitigating risks associated with resource price volatility. Botswana’s effective resource management serves as a model for other developing countries.

In conclusion, the findings of this study provide a robust foundation for understanding the critical role of macroeconomic policies in enhancing GDP growth in developing African countries. By adopting the recommendations and addressing the identified challenges, policymakers can formulate and implement effective strategies that foster sustainable economic development and prosperity. The study’s insights and proposed future research directions aim to contribute to a deeper understanding and better implementation of economic strategies that can drive growth and improve the quality of life for populations in these nations.

References

Acemoglu, D., Johnson, S. and Robinson, J.A. (2003) ‘An African success story: Botswana’, In Search of Prosperity: Analytic Narratives on Economic Growth, pp. 80-119.

Aghion, P., Akcigit, U. and Howitt, P. (2013) ‘What Do We Learn From Schumpeterian Growth Theory?’, Handbook of Economic Growth, 2, pp. 515-563.

Alesina, A. and Ardagna, S. (2010) ‘Large changes in fiscal policy: taxes versus spending’, Tax Policy and the Economy, 24(1), pp. 35-68.

Bernanke, B.S. (2010) ‘The Federal Reserve’s exit strategy’, Federal Reserve Board of Governors.

Blanchard, O. and Leigh, D. (2013) ‘Growth forecast errors and fiscal multipliers’, American Economic Review, 103(3), pp. 117-120.

Friedman, M. (2007) ‘The Role of Government in Education’, Economics and the Public Interest, pp. 123-144.

Keynes, J.M. (1936) The General Theory of Employment, Interest, and Money. London: Macmillan.

Obstfeld, M. and Rogoff, K. (2009) ‘Global imbalances and the financial crisis: products of common causes’, Federal Reserve Bank of San Francisco Asia Economic Policy Conference.

Romer, P.M. (1994) ‘The origins of endogenous growth’, Journal of Economic Perspectives, 8(1), pp. 3-22.

Smith, A. (1776) An Inquiry into the Nature and Causes of the Wealth of Nations. London: W. Strahan and T. Cadell.

World Bank (2018) Rwanda Economic Update: Unearthing the Subsoil – Mining and its Contribution to National Development.