The Senate has approved President Muhammadu Buhari’s request for the authourisation of ₦2.343 trillion ($6.183 billion USD) as External Borrowing in the 2021 Appropriation Act.

This was just as it directed the Minister of Finance, Budget and National Planning, Zainab Ahmed, the Director-General of the Debt Management Office, Patience Oniha, and the Governor of the Central Bank of Nigeria, Godwin Emefiele, to submit to the National Assembly within ten working days (excluding the day of close of trading), a letter containing the United States Dollars amount so raised and received as a result of the approval together with the applicable exchange rate.

The approval by the upper chamber followed the consideration of a report by the Committee on Local and Foreign Debts.

Read Also: Only In Africa, A Charlatan As Buhari Can Make It To The Top

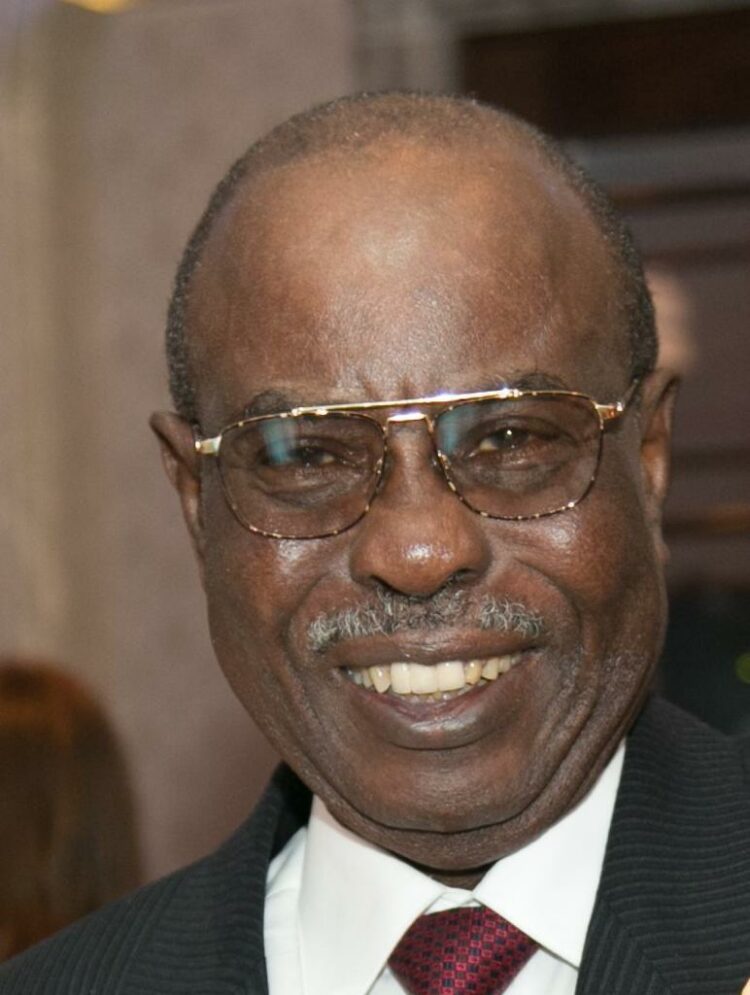

Chairman of the Committee, Senator Clifford Ordia (PDP, Edo Central), said that in considering the President’s request, the Committee noted the serious concerns of Nigerians about the level of sustainability and servicing of Nigeria’s External Borrowing.

According to him, ‘due to the short fall in our annual revenues in relation to our need for rapid infrastructural and human capital development, we had to pass deficit budget every year requiring us to borrow to finance the deficit in our budget.’

He emphasized that the proceeds of the USD$6.183 would be used to fund various specific capital projects specifically from priority sectors of the economy namely; Power, Transportation, Agriculture, and Rural Development, Education, Health, Provision of counterpart funding for Multilateral and Bilateral Projects, Defense and Water Resources.

The lawmaker disclosed that the final terms and conditions – the interest rate and tenors in the case of Eurobonds – can only be determined at the point of issuance of the Bonds in the International Capital Market and would be subject to market conditions prevailing at the time of issuance.

He added that the Primary listing of the Bond will be on the London Stock Exchange while the Secondary Listing will be on the Nigerians Stock Exchange and Financial Markets Dealers Quotations (FMDQ) Securities Exchange.

Accordingly, the Senate while adopting the resolutions of the Committee on Local and Foreign Debt approved the issuance of $3 billion USD but not more than $6,183,081,643.40 Eurobond in the International Capital Market for the implementation of the new External Borrowing of ₦2,343,387,942,848, for the financing of part of the deficit authorized in the 2021 Appropriation Act.

AFRICA DAILY NEWS, NEW YORK