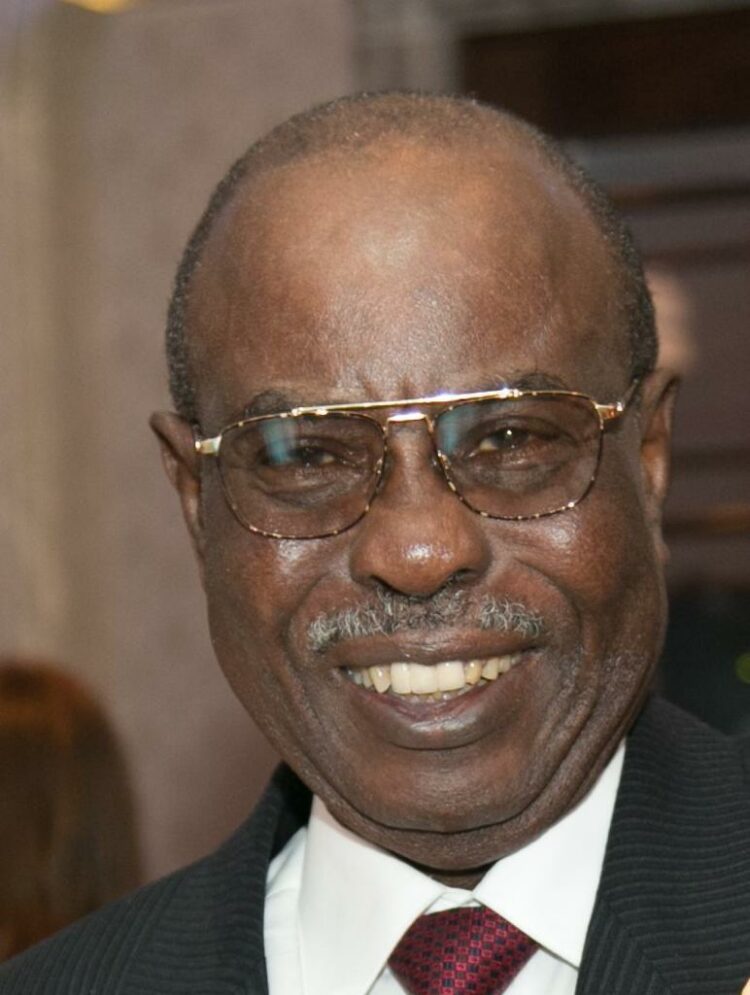

President Muhammadu Buhari on Thursday said the government had ‘inevitably’ resorted to borrowing to fund the budget as a result of declining revenues for some years’ resulting to increase in Nigeria’s debt profile.

President Buhari said this while speaking virtually at the FIRS National Tax Dialogue held at the Conference Hall of the State House, Abuja.

According to him; ‘As we might expect, this has led to increase in Nigeria’s debt profile which stood at about N32 trillion in September 2020. This funding gap created by the dwindling government revenue, therefore, underscores the importance of the national tax dialogue we are holding today.

Read Also: Federal Government To Pay 2.5% Discount In Loot Recoveries

Speaking through a statement issued by his spokesman, Femi Adesina, he said ‘No nation has ever made progress without having to pay for it or make the necessary sacrifice. I, therefore, call on all Nigerians to be alive to their tax obligations. This government is strategically restructuring the tax revenue mix in favor of indirect taxes in accordance with our national tax policy document.

‘To this end, the Federal Inland Revenue Services (FIRS) is mandated to do all that is required in order to efficiently collect tax revenue due from transactions carried out using local and foreign online platforms. The government has made a relevant statutory amendment to tax laws in the Finance Act 2020,’

‘Pay your tax’

The President directed foreign and local companies to ensure strict compliance with the payment of taxes.

Buhari, who particularly directed FIRS and related government agencies to plug all revenue leakages by ensuring strict compliance of tax payments by foreign companies operating in Nigeria, called for the deployment of more digital platforms and seamless connections.

He ordered all government agencies to automate operations and ensure more synergy in advancing the interest of the nation in revenue generation.

‘It is not enough that our citizens and local businesses pay their fair share of taxes. Equally, foreign businesses must also not be allowed to continue to exploit our markets and economy without paying appropriate taxes. Accordingly, the FIRS has my mandate to speedily put all measures in place to fully implement programmes to stamp out Base Erosion and Profit Shifting in all their ramifications and generally automate its tax processes.

‘In line with this, I have directed all government agencies and business enterprises to grant FIRS access to their systems for a seamless connection. FIRS must ensure that its deployment of technology for automation is done in line with international best practices. In particular, FIRS can borrow a leaf from other countries which have successfully automated their tax processes,’ he also said.

The President, who said Nigeria will continue to work with the Inclusive Framework (on equal footing) to develop internationally acceptable rules for taxation of the digital economy, expressed hope that ‘the Inclusive Framework would have evolved into an acceptable multilateral solution that will comprehensively address the tax challenges of the digitalized economy by the middle of 2021.’

President Buhari assured citizens that the government will continue to pursue its mandate of improving lives through investments in infrastructural projects like railways, roads, electricity, healthcare, and education, in spite of dwindling revenues and the challenge of coronavirus.

‘Our government has continued to pursue all those projects despite the massive decline in government revenues occasioned by a combination of factors among which is the COVID-19 pandemic.

‘The devastating effect of COVID-19 on the health and economy of the world is evident across every strata of our society. It is obvious to every citizen of this country that our economy is not immune from the global economic downturn. As such, we have had to confront the conflicting situations of reflating the economy and at the same time raising revenue to meet our budgetary needs. It is within this context that the government undertook an expansive budgetary projection of over N13 trillion for 2021.’

The President, who urged all citizens to play more active roles in nation-building by paying their taxes, said ‘the administration is, however, not seeking to increase the tax burden upon the citizens but to plug the existing tax loopholes or leakages and to ensure even and equitable application of the tax laws.’

AFRICA DAILY NEWS, NEW YORK